Flexible Payroll Software

Do the system used is suitable for you according to your company policy?

Can I do the payroll once; I not need to do in further especially the basic pay and fixed allowance and deduction?

Can the system automatic pick up the employee, who entitles for?

Predefine table

Security protect your sensitive data

Government Reports

Multiple User Define Fields with Formula

Integrated with accounting system

Optional Report Writer

Way of Managing

Setup the system according to your company policy is very essential to the organization. E.g. those who coming in late for 4 hours, deduct one day annual leave.

Eliminate Error and Time Saving

Immediate prints out the Pay Slip and Reports after entering the employee maintenance.

Every month Pay Slip and Reports automatic generated after month end, accept monthly different transaction like unfixed allowance, Deduction, Overtime, Pieces Done and etc.

System Automatic Pick up Employee

The system is able to pick up those who entitle for the transaction. Example, the payroll personnel may not know who is entitled for petrol allowance and there is 20 employees are entitled to the petrol allowance. User just enter the Quick Transaction, the system will pick up employees entitle for the petrol allowance and automatic doing 20 allowance transactions to the individual account.

Predefine Table

All the table can be predefine, especially; EPF, SOSCO, and Income Tax Table can be change, delete and add new table. When the government change the EPF, SOSCO and Income Tax Table, user can do it.

Government Reports

Sufficient Government Reports for user to export or summit in to the government body.

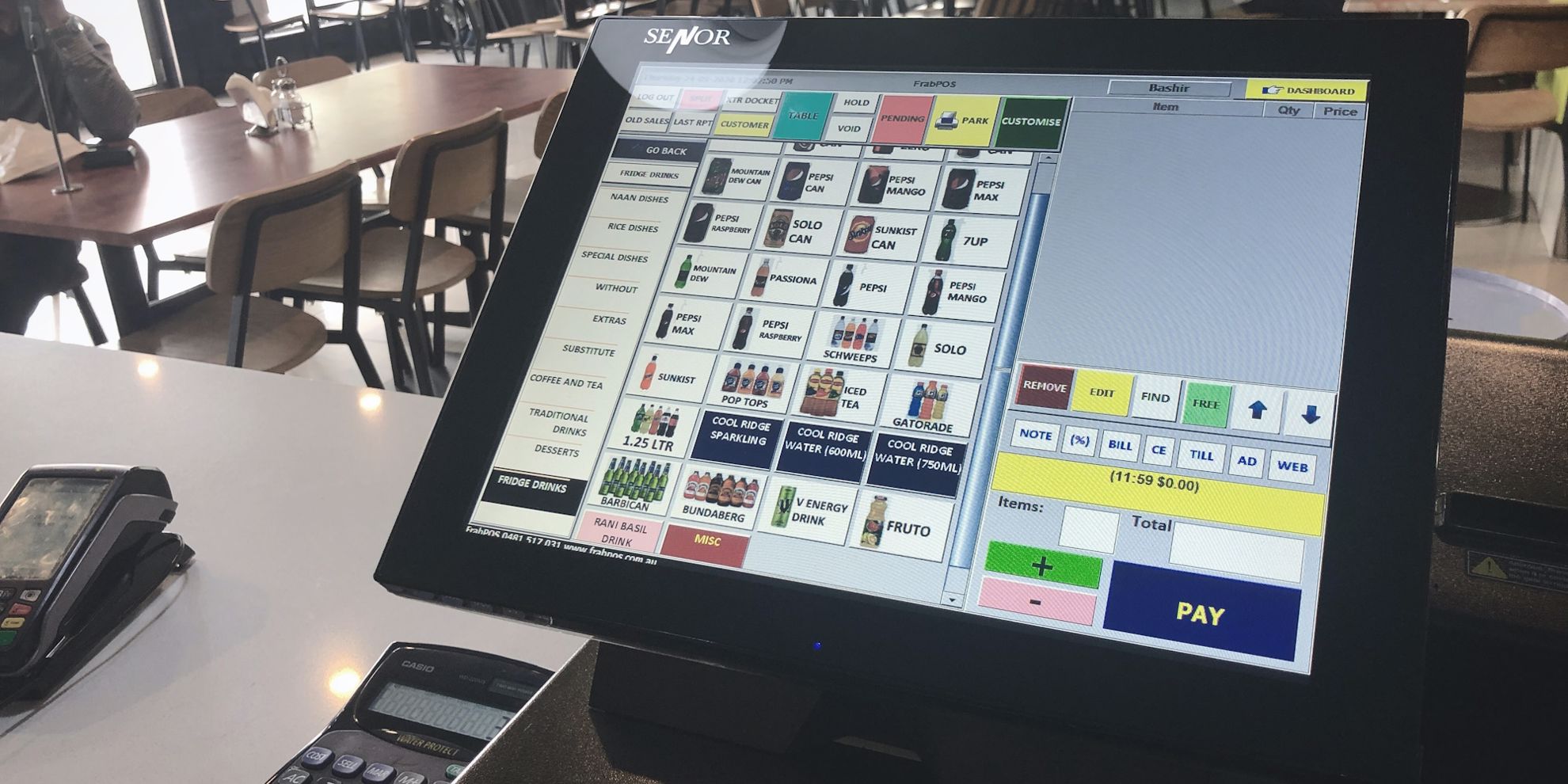

Security Protecting Sensitive Data

Highly confidential and privacy data need to protect from leaking to unauthorized person. Example, when you are very busy and you ask some once doing the allowance for you. You need assign the job. The person logs in only the allowance transaction is appearing on the screen. The rest of command and information is out of menu.

Multiple level User Define Formula and Fields

Use can preset the user define fields and writing the formula return back to the fields. Example, If you make this item one piece is $5.00, today you make 100 pieces. Your today total pay is $5.00 x 10=$50.00.

Integrated with Accounting System

The payroll data can be updated to accounting system. User is not need to do the double entry.

Default Reports Generated from Payroll

Employee Personal Listing

Employee Code setting Listing

Joined / Resigned Employee

Employee to be Confirm Listing

Work Force Analysis

Salary Analysis

Birthday Listing

Year of service Listing

Employee Age Analysis

Management Reports

Pay slip

Modify Pay Slip

Leave Entitlement & Taken

Pay Slip Listing

Bank Listing

Denominations Listing

Allowance & Deduction Listing

Overtime Listing

Monthly summary

Advance Pay

Bonus

Individual PCB Deduction

Check Account Listing

Daily / Hourly Rate Listing

Employee Overtime Detail Listing

Annual Leave Report

Yearly allowance & Deduction

Yearly Pay

Annual Income Statement

Year Allowance & Deduction

Annual Leave

Zakat Listing

Government Reports

EPF Borang A

SOCSO Borang 8A

SOCSO Borang 2

SOCSO Borang 3

EPF, SOCSO & PCB Listing

ASB & Tabung Haji Listing

ASB & Tabung Haji Previous Month Listing

HRD Levy Listing

Income Tax – CP 39 (PCB)

Income Tax – CP 22

Income Tax – CP8D

EA Form

Income Tax – CP159

Optional: -

Human Resource cans Integrates with Payroll. Payroll Report Writer is Optional to create additional Reports.